Dividend Policy / Return to Shareholders

Dividend Policy

Interim and final dividends consist of the performance-linked dividend, and the performance-linked and additional dividend respectively.

- For the performance-linked dividend, 25% of the half-yearly consolidated net income of each the interim and final dividends will be distributed. (*)

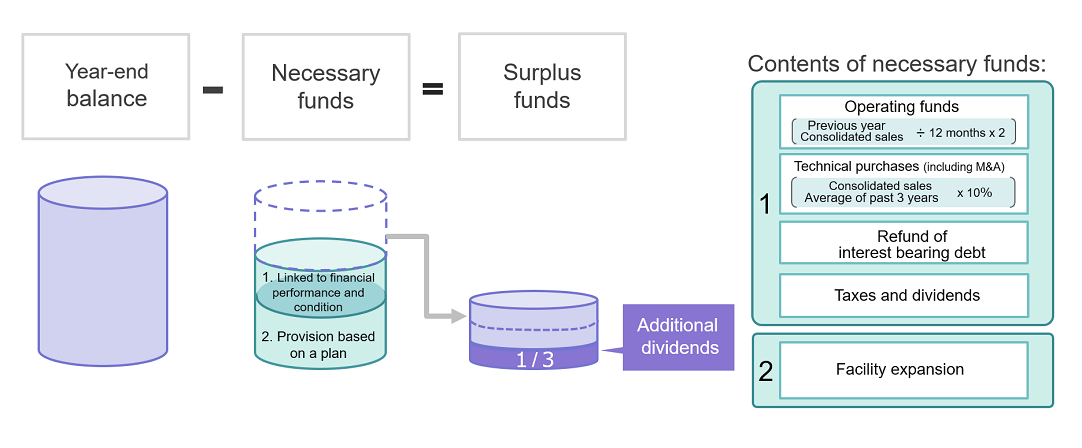

- Except when there is a loss, one-third (1/3) of the surplus funds after deducting the funding requirements from the year-end balance of cash and deposits is added to the final dividend as an additional dividend.

- (1) Funding requirements linked to business performance and financial conditions: the total of working capital, acquisition of technology resources, long-term interest-bearing liabilities, taxes, dividends, etc.

- (2) Allowance based on plans: mainly funding for facility expansion, such as construction of new buildings in the factories. If there are no plans, it will be zero.

Calculation Formula for Additional Dividend

*Irrespective of the level of income, we will maintain a reliable dividend of ¥10 per half-year. This means that the minimum yearly dividend will be ¥20. The ¥20 payout stipulated in our stable dividend policy may be reviewed if there are consolidated net losses in three consecutive years.

Decision Making Board / Record Date

The Board of Directors determines the interim dividend and, as a rule, the General Shareholders Meeting determines the final dividend.

Record Dates:

Interim dividend: September 30th

Final dividend: March 31st

At the Ordinary General Shareholders Meeting on June 29, 2022, with the aim of ensuring a flexible dividend policy, DISCO made the following amendment to the Articles of Incorporation:

"Unless otherwise provided for by laws and regulations, the Company may, by resolution of the Board of Directors, determine Dividends of Surplus and other matters set forth in the items of Article 459, paragraph 1 of the Companies Act."

However, regardless of these regulations, the General Shareholders Meeting will as a rule continue to determine the final dividend going forward. The Board of Directors will make the decision only in the event that convening the General Shareholders Meeting is deemed difficult due to disaster or other unforeseen circumstance.

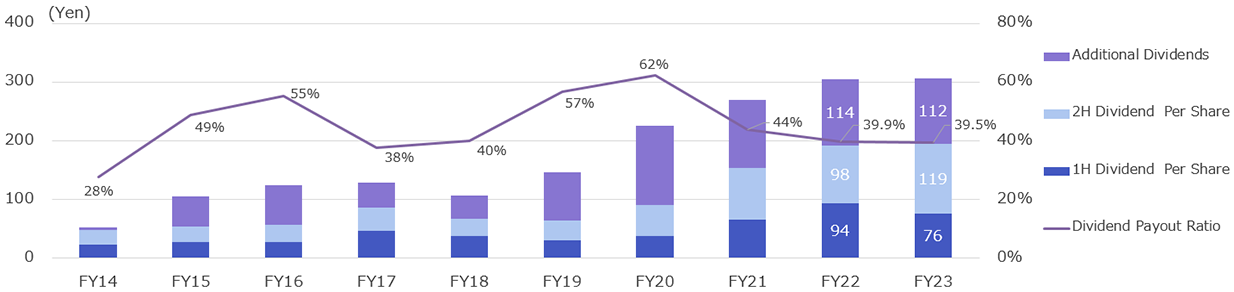

Dividend Trend

| Dividend Per Share | Dividend Resource | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1H | 25% of the half-yearly consolidated net income |

28 | 28 | 47 | 38 | 30 | 39 | 66 | 94 | 76 | 124 |

| 2H | 26 | 29 | 40 | 29 | 34 | 52 | 87 | 98 | 119 | 163 | |

| Additional Dividend | Surplus funds in the year-end balance |

51 | 68 | 43 | 40 | 82 | 135 | 116 | 114 | 112 | 126 |

| Annual dividends | - | 105 | 125 | 130 | 107 | 146 | 226 | 269 | 305 | 307 | 413 |

| Payout Ratio | - | 48.8% | 55.3% | 37.6% | 40.1% | 56.9% | 62.4% | 44.0% | 39.9% | 39.5% | 36.1% |

※The Company implemented a stock split in the proportion of 1 share into 3 shares effective as of April 1, 2023.

Dividend Amount and Net Assets per Share are caluculated taking into account the stock split implemented on April 1, 2023.

Total of itemized figures may not add up to totals because itemized figures are rounded.